Consumer Subscription: Leading the Wave of Consumption in Consumer Tech

By Jessie Cai

With support from Thomas Lee and General Atlantic’s growth acceleration team, and Tanzeen Syed and General Atlantic’s consumer tech team.

Twenty years ago, families drove to Blockbuster to pick out a single movie for $2.99. Aspiring Francophiles paid $50 per session to learn French, based around a set schedule. Weekend warriors set out for hikes, armed with compasses and paper maps.

Today, we pay 50 cents a day for unlimited entertainment through Netflix and Disney+. We can learn languages anytime, anywhere, on Duolingo’s mobile app for $6.99 per month. And we have enriched and user-recommended trail maps on our smartphones, via apps like AllTrails and OnX.

Subscriptions like these are taking more of our wallet share, but this isn’t just a new revenue model. The value we receive is orders of magnitude greater than legacy alternatives, and thus massively deflating the cost of services.

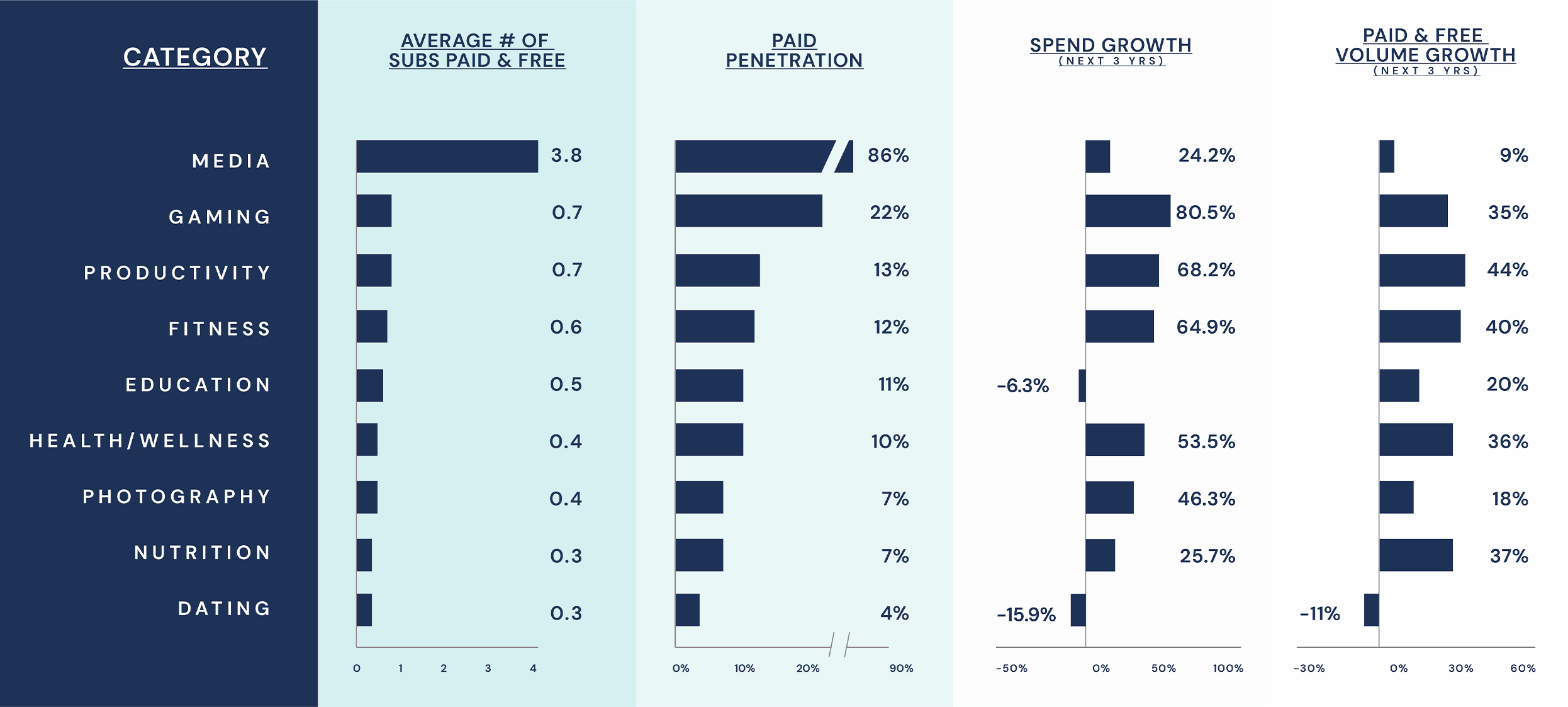

Media and entertainment have been at the forefront of this subscription boom. Proprietary research by General Atlantic’s Growth Acceleration team indicated that 68 percent of today’s subscription spending goes to platforms in those verticals. However, the consumer subscription model is also moving to other verticals, ranging from fitness to education and content creation.

There’s still room to grow – especially for businesses delivering incremental value to consumers. And there are some lessons to learn from the successes of early winners.

The Proliferation of the Subscription Model in Consumer Tech

In the broader consumer app industry, downloads and spend have increased dramatically.

In 2021, 233 apps generated over $100 million in consumer spend and 13 topped $1 billion in revenue – up from 193 and 8 in 2020, respectively.1 In July 2022, US mobile app store consumer spend for non-games finally exceeded games.2

GA’s proprietary survey of 1,500 US consumers found that the average consumer has 4.1 paid subscriptions today, and they expect that number to increase by 29% over the next three years. Over the next three years, consumers expect annual spending on subscriptions to increase by 33%, from $621 to $829. While media helped pave the way for paid subscriptions, many verticals remain underpenetrated.

Consumer Subscription Engagement and Spend by Category

Investors and entrepreneurs have long admired the software subscription model. Now, consumer-facing businesses have some of the same features, often with more attractive metrics.

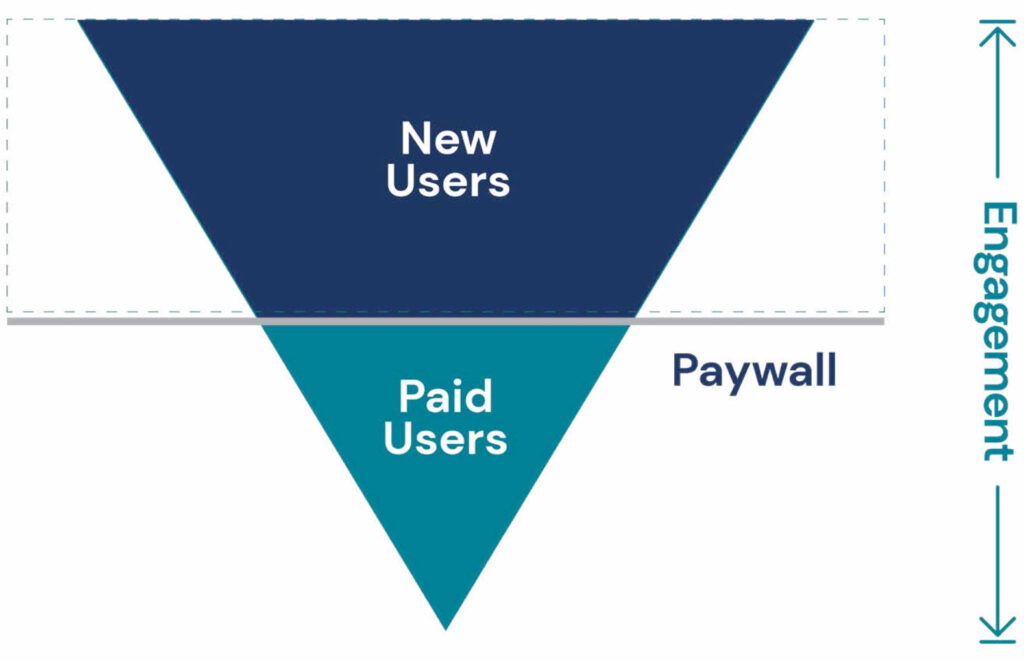

For example, while enterprise software businesses have entire salesforces dedicated to selling new logos and upselling existing logos, the customer acquisition costs (CACs) associated with consumer subscription freemium businesses are meaningfully lower due to the funnel of free users.

While these findings highlight increasing willingness to engage with and pay for consumer apps, competing for mindshare is increasingly important in a world of app proliferation. Macro headwinds also remain a concern for consumer spending. CNBC and Momentive’s recent survey of 4,000 adults indicated that 35 percent of consumers cancelled a monthly subscription over the past 6 months, amid inflationary pressures.3

Consumer subscriptions present a compelling opportunity – but with app proliferation and customer distraction in mind, what can companies do to stand out?

With lessons from some of the industry’s early movers and category pioneers, General Atlantic has identified market-tested insights and strategies for developing a “how to win” mindshare and market share at each level of the funnel.

Part I: Top of the Funnel

User growth is a powerful metric. It’s an initial indicator of product-market fit – a sign that a value proposition resonates with customers. That said, the way a company achieves user growth matters, especially as you consider levers to both continually drive user growth and retention and monetization. For example, while paid marketing can be tempting and boost user growth – it can be expensive and attract fickle users that may not be optimal for conversion.

How do some best-in-class businesses “win” when growing top of funnel?

1. Network effects are extremely powerful for cheap customer acquisition and driving stickiness. Are there aspects of the product or service that are naturally conducive to virality? What type of network effects can you intentionally build into the product flow and experience?

AllTrails enjoys strong network effects from users sharing elements of their traditionally offline life – runs and trail recommendations – with one another via a seamless digital network. This user-generated content (UGC) improves the customer experience, supplementing existing content with insightful details, photos, and reviews.

LinkedIn started as an invite-only platform and experienced hypergrowth immediately after launching. Once members joined the platform, they invited their colleagues and friends, amplifying the value of the professional network for all others. As the network grew, so did user engagement.

2. Building an ecosystem and community as part of a product offering helps to draw in new users.

With Strava, the ability to share activities with friends makes traditionally independent activities, like running or cycling, social. Additionally, in-person running groups can log their activity on Strava – moving their ‘offline’ community online.

Historically, chess players would have to go to different places for content and community, either playing on web-based products or relying on offline options to play with friends. The Chess.com team saw this as a pain point and started by focusing on community and content.

“There was a real authenticity about what we were doing, and the community could sense that,” Chess.com founder and CEO Erik Allebest said. “We pioneered live streaming chess, we created instructional written content, we had forums and clubs. We built everything we wanted as chess players.”

See how Chess.com CEO Erik Allebest’s Passion for the Game Drove Success

The founders of Chess.com – all avid chess players – realized 16 years ago there was more to be done to serve the world’s 600 million chess players and spread passion for the game.

“Our goal wasn’t to start a business,” founder and CEO Erik Allebest noted. “We have always been product-driven. Our mission was to create the chess platform that we wanted to play on as players. As chess players, we were relentlessly focused on making Chess.com what we wanted it to be.”

Chess.com is now the leading online chess play app globally, with ~90 million downloads, 20 million monthly active users and 5 million daily active users. They reached this scale with essentially no marketing spend. They have built Chess.com with a nearly 100 percent organic user base, which experienced explosive growth during COVID and after the release of the Netflix hit The Queen’s Gambit. How did they do it?

Building a powerful online chess community.

Historically, chess players would have to go to disparate sources for content and community, either playing on web-based products or relying on offline options to play with friends. Recognizing the pain point here, the Chess.com team started by focusing on community and content.

“There was a real authenticity about what we were doing, and the community could sense that,” Allebest said. “We pioneered live streaming chess, we created instructional written content, we had forums and clubs. We built everything we wanted as chess players.”

Enabling network effects.

Playing with friends is part of the experience and Chess.com met and continues to meet this need by enabling gameplay with friends, and posting results on leaderboards.

In addition, Chess.com enjoys significant organic growth through word of mouth. Our Growth Acceleration team’s survey work revealed ~40 percent of users discovered Chess.com through a friend or family member and, more broadly, ~50 percent of turn-based games are played against friends.

Another feature fueling network effects is “Daily Chess”, the app’s asynchronous play option that allows friends with busy schedules to make a move in their own time. In addition, Chess.com has positioned itself as a prominent platform in online chess through Twitch events, live streaming, and chess tournaments, which drive millions of viewers.

Delivering personalized and unique content. Chess.com’s personalization is critical as players improve. To help players learn, Chess.com provides various modules including “Game Analysis”, where users have the opportunity to run their games through AI models. The AI reviews your moves, analyzes what you did well, and identifies areas of improvement with specific suggestions.

“Chess is a natural game of progression and learning,” Allebest said. “People want to sharpen their skills and improve their rating – they can do that by playing, but they can do it better by using tools. And we provide those tools. For Game Analysis, we have been working hard on AI that will explain the game to you like a virtual coach.”

Chess.com’s founders have channeled their passion for the game to create a product that sustains user engagement and continues to bring new users into the fold. It’s an example of a consumer subscription winning with key top of funnel tactics.

Chess.com company data as of September 2022.

3. Unique and curated content helps consumers break through the noise of a crowded digital world, driving huge organic growth.

Grammarly, a cloud-based writing assistant, offers its 30 million users personalized suggestions to improve their writing. Through advanced machine learning, Grammarly’s recommendations go beyond basic grammar and generic writing tips.

Companies like Levels or Whoop, by definition, generate unique content to each user – with individualized and real-time scores on Metabolic Health or Recovery based on each individual’s own movement, diet and sleep habits.

Part II: Engaging and Retaining

Once an app has users’ attention through an initial download or trial, the next step is engagement and retention. There are several effective ways to engage a user base.

1. Become the system of record. When companies become the go-to platform for tracking critical aspects of users’ lives, retention skyrockets, as deleting an app means also deleting valuable data.

Fitness trackers like Whoop and Oura have positioned themselves as the system of record for overall well-being, whether it be recovery or sleep. These devices are worn 24/7 and track movement and sleep quality through body temperature and heart rate. The power of these tools relies on around-the-clock usage, and the longer a user is on the platform, the more valuable insights they can receive. Countless other examples can be seen in companies like Strava for fitness, MyFitnessPal for calorie tracking or Flo for period tracking. Once you’ve recorded your menstrual cycles in Flo, it only makes sense to continue using the Flo app, as it uses your historical data to become more intelligent in predicting your cycles over time.

Gympass – a corporate benefit platform providing employees with an all-in-one subscription to gyms, studios, and health app content – is another great example of adapting to unlock the right features. While they are primarily focused on engaging employers, employees can also opt-in to individualized plans that work best for them – whether it be a starter pack with over 2,000 gyms for $11.99/month, or a Diamond pack with access to over 10,000 gyms and virtual personal training sessions for $279.99/month.

2. Create new habits and solidify old ones. Integrating habits into everyday user life is an incredibly powerful way to drive retention.

Companies like Headspace and Calmare great examples of driving value by deeply entrenching habits. Their quick and digestible meditation modules, suggested based on time of day, can easily be integrated into a bedtime or morning routine.

Pray.com and Glorifyoffer a model for tapping into existing habits. In this case, they support users’ ritual of daily prayer, offering easily accessible and bite-sized daily passages and devotionals.

Rent the Runway– with a subscription model that enables multiple “swaps” per month – has instilled the notion that they are not just for one-time occasions, but a critical part of your weekly wardrobe. This draws users to continuously check for new items and “curate” their own virtual closets.

3. Gamify and tap into personal development. Gamification encourages learning among users, driving engagement and retention.

Tinder revolutionized dating not by inventing the concept of swipe left / swipe right, but by gamifying this concept, bringing it to mobile and sparking instant user gratification. Gone are the days of scrolling through a web feed of potential matches – Tinder moved online dating to a more engaging, fast paced, and dynamic mobile experience, perfect for millennial daters. Similarly, Duolingo – whose vision is to make all learning content available accessible – has a gamified structure which makes learning a new language less intimidating. More on this below.

Read more insights from Duolingo CEO Luis Von Ahn

Duolingo is disrupting a $60 billion language learning market, which is only 20 percent online today and even lower on mobile. It has become the world’s leading language learning app, offering courses in 40 languages to approximately 42 million monthly active users.

CEO Luis von Ahn founded Duolingo with an ambitious vision – to help build a future where high-quality education is available to everyone, no matter where they live or how much money they have. Duolingo operates with a freemium model where most users learn for free, while generating revenue through paid subscriptions and ads.

“We built a massive business without charging for learning,” von Ahn said. “All learners – whether they pay us or not – get the same course, the same explanation, the same high-quality instruction.”

Duolingo remains focused on making learning as fun, personalized, and as accessible as possible by leveraging smartphone technology’s all-encompassing reach. Today, people Google “Duolingo” nine times more often than “learn Spanish”, essentially making Duolingo synonymous with language learning. So how did they accomplish this?

Prioritizing mission.

Duolingo’s success began with its co-founders’ drive to make an impact on the world. This meant making choices like intentionally keeping all learning content in front of the paywall.

“What we now know is that our mission has just been really good for business, because we do things thinking of the long view as opposed to trying to squeeze things in the short-term,” von Ahn said. “Early on, people would say ‘guys you’re nonprofit.’ But no, we’re a for-profit organization [and] one of the main drivers of revenue has been to be able to reinvest into getting more users, and then through that having more of an impact.”

Relentless focus on customer experience.

Duolingo believes that focusing on the customer will lead the way for a better user experience and thus monetization. They look at 30-40+ metrics, most of which are engagement metrics and only a few tied directly to monetization. This has propelled a flywheel, utilizing data and insights from its user base to create more engaging and effective learning experiences, driving monetization of free subscribers instead of relying on paid marketing spend.

Current User Retention Rate: consumers active in the current time period who were also active in the previous time period that you’re measuring (i.e. the past 7 days)

“If I could only optimize one metric in my life, the metric would be this thing called ‘current user retention rate’. This is a magical metric. If someone was using the app today, and another time in the last seven days – that’s called a ‘current user’. Today for us that metric is close to 80 percent.”

A/B Testing.

Duolingo runs thousands of A/B tests to optimize each feature for maximum engagement. Millions of learners complete over 500 million exercises every day, creating what we believe to be the world’s largest learning dataset.

“We are crazy about A/B testing. We run maybe 750-1000 A/B tests per quarter. Pricing [of course], but we also do all sorts of things, such as location of a button, a new feature – literally everything. By the time we launch of a feature, we know what it will do to every metric, and we make decisions based on that.”

Solidifying habits through gamification and low-barrier exercises.

Bite-sized, mobile-friendly exercises make it easy for Duolingo users to routinize a language learning habit.

“You can have a session in two minutes, and in fact, we would like them to be shorter. People may stay on more than 30 minutes, but the minimum commitment is only two minutes.”

The gamified structure makes learning a new language less intimidating. Duolingo dynamically pushes a wide variety of gamified exercises that are engaging, comprehensive, and easy to digest. Think word-matching, translation, “type what you hear” and “speak the sentence.” They also weaved in the concept of streaks.

“We added milestones, which people really care about. A 30-day or 100-day streak, it’s a big deal. Perfection is hard, and we used to require perfection. But now we do ‘streak freezes’ that allow you to miss a day here or there. Generally, we want a habit of using Duolingo every day – but we know that sometimes you will be busy. We noticed that people would leave Duolingo [if their streak went down to zero], because that’s extremely demotivating. So, we let you miss a few days here or there. We’re trying to build a habit here.

Building on community to make learning social.

Product features like leaderboards keep learning social and fun. You can track your family members on leaderboards, or high-five friends on a streak to keep them motivated. The ability to add friends to the platform encourages this sharing with others, and learning a new skill alongside close friends encourages retention, engagement, and a sense of community.

Unique content and personalized learning pathways.

Duolingo uses gamification with AI-influenced personalized learning pathways to deliver a more enjoyable and effective learning experience. This includes the perfect balance of difficulty for an individual’s lessons to meet the learner where they are.

“Not many people talk about it because they don’t notice it, but our lessons are exactly right for you. This took us a while to optimize. Basically, when we give you an exercise, we know the probability you get that exercise right is on average 83 percent,” von Ahn said.

Duolingo’s quest to engage and retain users has in many ways been second nature given its mission-driven and product and community-focused roots.

Duolingo company data as of June 2022.

Part III: From Freemium to Premium

With sticky users aplenty, the final step is paid conversion. Providing the right premium features, having the right amount of “friction” in free plans, and creating a seamless sign-up process helps maximize paid conversion. There are also opportunities to monetize traffic and the free user base.

1. Provide the right unlockable features. Deciding which features to put behind a paywall can prove difficult for any freemium business. A/B testing and market research are two critical ways to collect data on what users are willing to pay for. Features that contribute to network effects should generally remain free, while advanced features for power users should exist behind paywalls.

Meanwhile, Strava’s most valuable features are its activity recording and social network – however, these features are considered table stakes, and users have low willingness to pay for them. Instead, Strava monetizes advanced features that power-users find valuable, such as route planning, advanced metrics, and goal setting. This results in paid conversion, while also offering many users a valuable free version with strong network effects.

Gympass – a corporate benefit platform providing employees with an all-in-one subscription to gyms, studios, and health app content – is another great example of adapting to unlock the right features. While they are primarily focused on engaging employers, employees can also opt-in to individualized plans that work best for them – whether it be a starter pack with over 2,000 gyms for $11.99/month, or a Diamond pack with access to over 10,000 gyms and virtual personal training sessions for $279.99/month.

2. Introduce just enough friction.

Spotify has market-leading conversion rates, thanks to their heavy use of advertisements within the free experience. Similarly, Duolingo allows free users to incorrectly answer just five language exercises per 24-hour period but encourages eager learners to convert if they want to continue learning that day.

3. Making sign-up seamless with varied pricing. This makes it more likely that a subscription sale will “land”, maximizing chances of user conversion. Understanding customers’ use cases will help companies design packages that align with customer needs.

CLEAR, the disruptive secure identity platform, provides subscribers with a best-in-class experience: frictionless travel. They offer a model of enrolling customers at the right friction point, where customers’ pain point is most acute: long airport security lines.

Headspace, NYT, and Spotify offer special pricing to audiences of limited means, such as students. They also offer varied durations of commitment, allowing users to align their paid packages with their personal preferences, improving odds of conversion.

4. Intelligently monetize free users. Selling paid plans is not the only way to monetize, and many of the best business models utilize their free user base to generate revenue. Selling ads is the most obvious way to do this and companies such as Hulu, Spotify, Quizlet and Duolingo all use this method to generate meaningful revenue.

Rewarded ads offer another option. Duolingo offers rewarded video ads to users that have no daily ‘hearts’ left, allowing them to take more lessons.

Mastering The Balancing Act

Can a company really have it all? Can a business continue to grow top-of-funnel and attract new users, while also focusing on monetizing? We have often found that in the early days of growing a user base, there is a delicate balance between a) optimizing top of funnel, a function of expanding total addressable market (TAM) and user experience, and b) middle / bottom of funnel, a function of introducing friction and unlocking exclusive “features”.

That said, many companies have successfully pulled the right levers to drive growth. Moving popular features behind the paywall, except those that impact network effects, was how Strava struck the right balance. The New York Times risked ad and subscription revenue to test a metered paywall – offering just 10 free articles per month – and it paid off. What other levers do companies have to test out? Try staggering price increases, grandfathering prices, or introducing in-app and one-off purchases. When done correctly, increasing prices does not need to impact top of funnel / network effects.

About The Author | Jessie Cai

Jessie Cai is a Vice President at General Atlantic, where she concentrates her efforts on investments in the technology sector with a specific focus on consumer internet and software. Jessie is active on the boards of Chess.com, the world’s largest online chess platform, and Kiwi.com, an online air travel platform. She also helped lead or support GA’s investments in EngageSmart (NYSE: ESMT), Articulate, Pendo, Vox, Buzzfeed, and Airbnb.

Before joining General Atlantic in 2018, Jessie was a Growth Equity Investment Associate at Summit Partners, where she focused on fintech and e-commerce investing, leading investments in EngageSmart, Quay Australia, and Grand Design RV. Jessie also worked as an Investment Banking Analyst at Citigroup. Jessie graduated with a B.A. Mathematics and Economics from Northwestern University and an M.B.A. from Harvard Business School.

In addition to her role at General Atlantic, Jessie is an Operating Board Member at Pursuit, a social impact organization that creates transformation where it’s needed most. Through their four-year intensive program, Pursuit trains adults with the most need and potential to gain their first tech job, advance in their career, and become the next generation of leaders in tech.

About General Atlantic and Consumer Subscription

General Atlantic has been fortunate to partner with several freemium and consumer subscription companies globally including BYJUs, CLEAR (NYSE: YOU), Chess.com, Duolingo (NYSE: DUOL), Gympass, Quizlet, Slack (NYSE: WORK), Squarespace (NYSE: SQSP), Typeform, and Vegamour.

General Atlantic is a leading global growth equity firm with more than four decades of experience providing capital and strategic support for over 445 growth companies throughout its history. Established in 1980 to partner with visionary entrepreneurs and deliver lasting impact, the firm combines a collaborative global approach, sector-specific expertise, a long-term investment horizon, and a deep understanding of growth drivers to partner with great entrepreneurs and management teams to scale innovative businesses around the world.

The views and opinions expressed herein are those of the General Atlantic investment team as of the date noted, are provided for general information only, and do not constitute specific tax, legal or investment advice to or recommendations for, any person. There can be no guarantee that any historical trends will continue or that any investment opportunities or exit paths will materialize.

The company logos in this article are for illustrative purposes only and do not necessarily represent General Atlantic investments. See above for the full list of General Atlantic’s subscription-based portfolio companies, and go to generlatlantic.com for the full list of all GA portfolio companies.